401k Max Contribution 2025 Employer Match Online. Contributions to 401 (k)s can be automatically deducted from your paycheck. Each year, there are contribution limits set for accounts like the 401(k) and ira.

Total contributions to a solo 401(k) cannot exceed $69,000 or $76,500 for those at least aged 50. The 401 (k) contribution limits for 2025 are $23,000 for individuals under 50, and $30,500 for those 50 and older.

Max 401k Contribution 2025 Including Employer Naukri Shay Benoite, Estimate your balance at retirement with this free 401(k) calculator.

2025 401k Contribution Limit Employer Match Aubine Carroll, Employer contributions do not count toward these limits.

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png)

401k Contribution Limits 2025 With Employer Match Kaile Marilee, These are not mandatory and are determined by each employer.

401k Max Contribution 2025 Employer Vera Allison, The contribution limit for simple 401 (k)s is $16,000 (up to $19,500 if you're 50 or older).

Max 401k Contribution 2025 Including Employer Elana Marita, The limit on employer and employee contributions is $69,000.

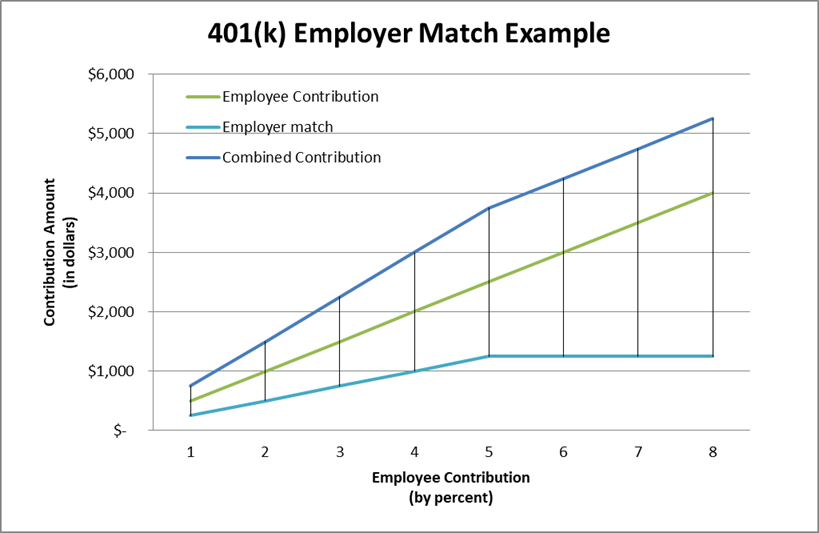

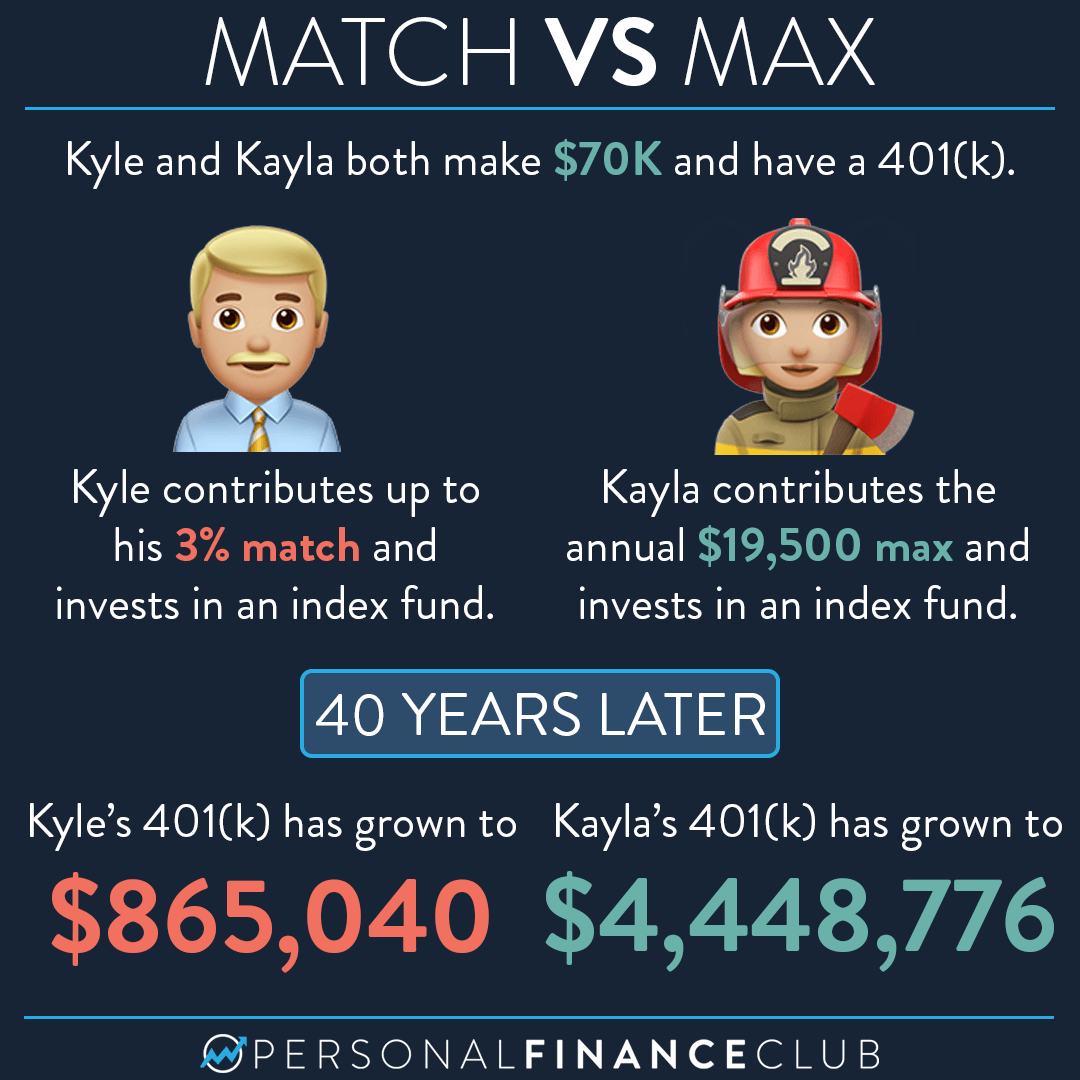

Max 401k Contribution 2025 Employer Match Jaine Lilllie, In addition to your own contribution via salary deferral, your employer might offer matching contributions to your 401(k) account.

Irs 401k Limits 2025 And Employer Matching Leyla Ophelia, If you contribute, say, $23,000 toward your 401 (k) in 2025 and your employer adds $5,000, you’re still within the irs limits.

Max 401k Contribution 2025 With Employer Match Grier Arabella, Employers must make a matching contribution of a maximum of 3% of a worker's salary or a nonelective contribution worth 2% of each participating employee's wages.

Max 401k Contribution 2025 Including Employer Pf Dotti Gianina, There are separate limits for how much you can contribute as an employee and how much you and your employer can contribute together.

Max 401k Employer Match 2025 Andie Blanche, However, the combined employer match and employee contribution in 2025 cannot exceed $69,000 or $76,500 for those 50 and up.